Agric, others suffer setback as lending rates favour governments

Agric, others suffer setback as lending rates favour governments

Banks are taking their scarce assets to governments as foreign exchange crisis and economic recession threaten return of investments.

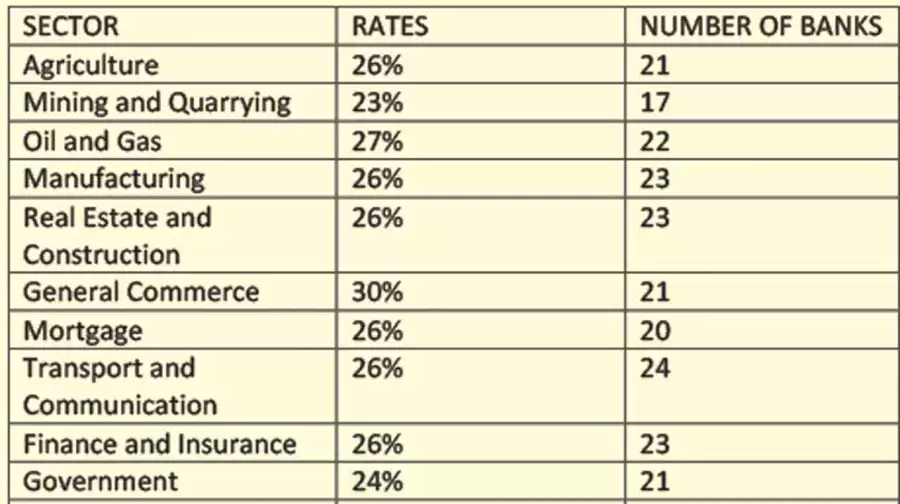

Lending rates to different sectors of the economy for the month of September as published by the Central Bank of Nigeria (CBN) show that deposit money banks see higher risks in lending to the private sector, including agriculture.

Loans to governments and Mining & Quarrying remain the lowest at 24 and 23 per cent respectively. For general commerce, oil and gas, construction, manufacturing, mortgage and agriculture, banks would charge the highest rates at 27 per cent on the average. Ostensibly due to exchange rate volatility, interest on loans to general commerce peaks at 30.14 per cent among 21 banks — the highest according to checks by The Guardian.

Apart from government’s special credit schemes for agriculture, commercial banks are not very keen on lending to the sector as the average interest rate for agric. loans stands at 26 percent.

At 14 percent benchmark rate created by the country’s banking regulator, deposit money banks have a window of between 15 and 17 percent. Also known as the Monetary Policy Rate (MPR), the benchmark rate represents the cost of funds for banks and has remained high at two digits in the last two years. The CBN cites liquidity issues and the need to stem inflation as reason for keeping MPR high.

In reality, banks’ lending rates go between 20 and 27 percent for most portfolios, as lenders insist costs for money and forex actually go beyond official rates. They also cite cost of doing business as reason for high lending rates.

“Banks’ poor attitude to agriculture lending shows that the mantra of diversifying the economy will not be achieved”, Dr. Franklin Ngwu, who teaches economics at the Lagos Business School, said on telephone.

The 18-month-old government of President Muhammadu Buhari has continued to mouth diversification as the solution to the country’s recessive economy. The apex bank has created pockets of agric credit schemes being disbursed through commercial banks. “But there is the need for deliberate private sector efforts to boost agriculture,” Ngwu said. “The banks are crowding out the private sector in the area of finance. And finance is critical to any development, especially in the area of agriculture,” he said.

But bank executives who spoke on the matter disagreed with Ngwu and refrained from commenting on why interest rates appear to be more favourable to public sector lending than to the private sector.

Asking not to be named, a managing director of a new generation bank said the posture on lending should be taken with a grain of salt. He agreed that lending to government remains safer for banks.

“I don’t see any bank lending aggressively to state governments that cannot even pay salaries; the safest area now is treasury bills,” he said .He further argued that high rates for government loans are mellowed by bailout loans to states. The Federal Government’s funds are disbursed to states at a negotiated interest rate, usually nine per cent, he said.

“The debt management office and the accountant general authorise and have to sign off on any loan to states or agencies of the Federal Government. What we do is to consider the weighted average. So, it must be a mix of interest rates that bring down the rates for government loans.

“Normally, when banks are given funds for on-lending, it usually comes at nine per cent. The CBN takes three per cent and the banks take the remaining six per cent. So, when a bank gives N100 billon of CBN funds at nine per cent and another N100 billion of its own funds at 23 per cent, the weighted average would become lower.”

Explaining why loans to the manufacturing sector could be low at this time, the bank executive said access to foreign exchange has remained a challenge and approved loans are often abandoned by manufacturers who cannot access forex to import raw materials. “Sometimes we approve credit for manu

![Narappa (2021) [Telugu]](https://www.memesng.com/r/storage.waploaded.com/images/8c6f990f7d188052856cff00ea081084.jpg?w=50&ulb=true&ssl=1)

![Fist of Fury Soul (2021) [Chinese]](https://www.memesng.com/r/storage.waploaded.com/images/5ac9ee77b2f59bb79067cf966b1dc6c3.jpg?w=50&ulb=true&ssl=1)

![Deadly Sniper (2019) [Chinese]](https://www.memesng.com/r/storage.waploaded.com/images/445d35579dd40dc9abd099188696abad.jpeg?w=50&ulb=true&ssl=1)

![Mission Yozakura Family (2024) [Japanese] (TV series)](https://www.memesng.com/r/storage.waploaded.com/images/5e3c9301c312f7d2339385ab24a18a7b.jpg?w=50&ulb=true&ssl=1)

![The Fable (2024) [Japanese] (TV series)](https://www.memesng.com/r/storage.waploaded.com/images/49816f6b0636782e57cbed9e792aa737.jpg?w=50&ulb=true&ssl=1)

{{comment.anon_name ?? comment.full_name}}

{{timeAgo(comment.date_added)}}

{{comment.body}}

{{subComment.anon_name ?? subComment.full_name}}

{{timeAgo(subComment.date_added)}}

{{subComment.body}}